It’s worth regularly to analyze available tax reliefs and deductions to optimize your settlements. The right actions can significantly and positively impact your finances. This is exactly what this article aims to achieve – we want to help you understand the reliefs you can benefit from.

In this text, we will discuss the 9 most important tax reliefs that you can take advantage of if you meet the required conditions.

What are they? Let’s get into the details…

- Child tax relief

The relief applies if you are a parent or act as a foster family, and your incomes are taxed under the tax scale.

When does it apply?

This relief is available in the following cases:

- For a minor (under 18) child,

- For adult (18 years and older) child:

– If the child was receiving attendance allowance or social pension,

– If up to 25 years of age the child is studying in Poland or abroad and their income did not exceed 19 061,28 PLN.

When can you not use it?

You cannot take advantage of the relief if you only earn incomes:

- taxed with a 19% flat tax (e.g. from a sole proprietorship),

- taxed with a lump sum tax.

However, if you also have incomes taxed under the tax scale (e.g. from work), you can take into account the relief on these incomes.

There are some limits

You are entitled to the relief if your incomes in the tax year did not exceed:

- 112 000 PLN – if you are married for a whole year (income summed with that of your spouse).

- 112 000 PLN – if you are a single parent.

- 56 000 PLN – if you are not married.

However, it is granted regardless of the amount of income if:

- You have two or more children,

- you have one child with a disability or an awarded pension.

Let’s finally say how much this relief is

The child relief is a tax-deductible credit. It reduces the tax payable, unlike most other reliefs that only reduce the tax base.

It is calculated as follows:

- For the first child: 92,67 PLN per month, which amounts to 1 112,04 PLN per year.

- For the second child: 92,67 PLN per month, which amounts to PLN 1 112,04 PLN per year.

- For the third child: 166,67 PLN per month, which amounts to 2 000,04 PLN per year.

- For the fourth and each additional child: 225,00 PLN per month, which amounts to 2 700,00 PLN per year.

The deduction applies jointly to both parents or married foster parents.

How to use it?

You must file a PIT-36 or PIT-37 with a PIT/O attachment.

- Thermal modernization tax relief

The thermal modernization relief is available to owners or co-owners of single-family houses (including terraced or semi-detached houses) who incur expenses related to the thermal modernization.

Thermal modernization includes the following activities:

- An upgrade that reduces the energy required for heating and hot water.

- Reducing energy losses in district heating networks and heat sources feeding these networks. However, only if provided that building meets the energy-saving requirements.

- Connection to a centralized heat source in place of a local heat source, resulting in lower energy acquisition costs for heating.

- Conversion of energy sources to renewable ones – total or partial (e.g. solar panels, heat pump) or use of high-efficiency cogeneration (production of electricity and heat in the same process).

When do you deduct such expenses?

In order to take advantage of this relief, you must meet several conditions regarding incurred expenses:

- List of materials and services:

- Expenses must be for building materials, equipment and services listed in the act that relate to the implementation of thermal upgrading projects.

- Expenses must be for building materials, equipment and services listed in the act that relate to the implementation of thermal upgrading projects.

- Project completion time:

- Thermal modernization must be completed within 3 consecutive years. It counts from the end of the tax year in which you incurred the first expense.

- Thermal modernization must be completed within 3 consecutive years. It counts from the end of the tax year in which you incurred the first expense.

- Invoices:

- Your expenses must be documented with invoices.

- Your expenses must be documented with invoices.

- No deduction claimed elsewhere:

- These expenses were not deducted in othey way.

How to take advantage and what to keep in mind?

- Identifying deductible expenses:

- You can deduct the allowance from your income on your PIT-36, PIT-36L, PIT-37 or PIT-28 returns, which must be accompanied by a PIT/O attachment.

- The amount of the deduction cannot exceed 53 000 PLN for all thermal modernization projects in a given building.

- You can deduct the allowance from your income on your PIT-36, PIT-36L, PIT-37 or PIT-28 returns, which must be accompanied by a PIT/O attachment.

- VAT amount:

- If you have incurred expenses subject to VAT, you can also deduct this tax. However, only if you have not deducted it elsewhere.

- If you have incurred expenses subject to VAT, you can also deduct this tax. However, only if you have not deducted it elsewhere.

- Deduction in subsequent years:

- If you do not deduct the entire amount of your thermal modernization expenses in a given year, you can carry forward the unrealized portion of the deduction to subsequent years. You can do this for 6 years from the end of the year in which you incurred the first expense.

- If you do not deduct the entire amount of your thermal modernization expenses in a given year, you can carry forward the unrealized portion of the deduction to subsequent years. You can do this for 6 years from the end of the year in which you incurred the first expense.

- Reimbursement of expenses:

- If you do not complete the entire thermal modernization project within 3 years, you will be required to repay the relief. In this case, you must add the amount of the relief to your income for the year in which the 3-year period expired.

- If you do not complete the entire thermal modernization project within 3 years, you will be required to repay the relief. In this case, you must add the amount of the relief to your income for the year in which the 3-year period expired.

- Refund of deducted expenses:

- If you receive a reimbursement for thermal modernization expenses in the year after you use the relief, you must add this amount to your income (revenue) for the year in which you receive this reimbursement.

You can also correct a previously filed return in which you applied the relief.

- Internet tax relief

Allows the deduction of expenses related to the use of the internet. Well, here we did not surprise anyone, but certain conditions apply.

What are the conditions?

You are entitled to the relief if you earn incomes taxed under the tax scale or a lump sum tax. You can use it by filing PIT-28, PIT-36 or PIT-37 together with a PIT/O attachment.

It is available only if you have not used this tax credit before or you used it for the first time in your 2024 return. It can only be used in two consecutive years.

Deduction limits

You can deduct internet expenses up to 760 PLN per year. This means that regardless of your expenses, you cannot deduct more than 760 PLN in one year.

This limit applies to the taxpayer (person). So, if the expense is incurred by spouses, each is entitled to the max limit, of course, not more than the amount of the expense incurred by each of them. Here unity does not apply!

Documentation!

In order to take advantage of the internet relief, you must have proper documentation to prove that you have incurred expenses for internet. Usually those are invoices from your Internet provider.

- Tax relief for juniors

Are you less than 26 years old? That’s perfect. Check out this relief for yourself.

What does this mean for you?

If you are less than 26 years old and have earned income from:

- employment,

- assignment contracts,

- graduate internship or student internship,

- maternity leave benefit,

they are exempt from income tax up to the amount of 85 528 PLN per year. You do not pay tax on these revenues, regardless of the number of contracts or employers.

Do you then have to file a statement somewhere?

You don’t have to if all your incomes are eligible for this relief.

For married people, the 85 528 PLN limit applies separately for each spouse.

- IKZE tax relief

Did you know that you can accumulate money (invest it) in an individual retirement security account (IKZE) and at the same time take advantage of a tax relief? Well:

Contributions can be deducted from:

- incomes taxed under the tax scale (PIT-36 and PIT-37),

- incomes taxed with a flat tax (19%, PIT-36L),

- incomes taxed under lump sum tax (PIT-28).

When are you eligible for this relief?

If you made contributions to an IKZE during the year. Simple huh? But…

We have some limits here, too

The contribution limit for IKZE is:

- 1,2 times the mean salary,

- 1,8 times this salary for sole proprietors.

These amounts are determined on the basis of the projections contained in the Budget Law or its drafts.

This means that the maximum limit for IKZE contributions in 2024 is:

- 9 388,80 PLN or

- 14 083,20 PLN (for sole proprietors).

You have to prove everything

It’s all about having all kinds of documents that confirm your IKZE contributions. This could be a transfer confirmation or an account summary provided by the fund where you have your IKZE account. That’s it!

- Tax relief for working seniors

What is it about? Well, as the name says, it involves the exemption from income tax for seniors, up to the amount of 85 528 PLN.

It applies for various sources, such as:

- employment,

- assignment contract,

- entrepreneurship (sole proprietorship or partnership).

Who can benefit?

You can take advantage of the relief if you are:

- woman over 60 years old or

- man over 65 years old

and, despite becoming eligible, you do not receive a retirement or family pension, or other cash benefit.

- Return tax relief

Here, the relief exempts from income tax, again up to 85 528 PLN of income, earned by you after your move or return to Poland.

Includes revenues from:

- employment,

- assignment contract,

- entrepreneurship (sole proprietorship or partnership),

- maternity leave benefit.

Who can benefit from it?

One who meets the following conditions:

- After December 31, 2021, relocated to Poland and became a Polish tax resident.

- Lack of residence in Poland for 3 years prior to the year of moving to Poland.

- Polish citizenship, Pole’s Card, EU/EEA/Swiss citizenship or tax resident status in several countries like Australia, USA, Canada, Japan and more. This means that mayn foreigners who have recently moved to Poland can also benefit from this relief!

- Certificate of residency or proof of residence.

- Has not previously taken advantage of this relief in whole or in part.

From when can the relief be applied?

This tax relief can be applied for four consecutive years, starting from:

- the beginning of the year in which you moved to Poland, or

- the beginning of the year following the year of move to Poland.

See you in Poland!

- Tax relief for families +4

Do you have a large family? This may be of interest to you! There is a relief for parents who have at least four children in a given year .

Deduction is again up to 85 528 PLN on the following sources:

- employment,

- assignment contract,

- entrepreneurship (sole proprietorship or partnership),

- maternity leave benefit.

It is worth remembering that relief is separate for each parent. So, you can both use this relief in above amount!

What children does the relief apply to?

The relief is available for:

- Minors (<18), regardless of their annual income,

- Adult children up to 25 years, studying in Poland or abroad, who did not earn more than 19 061,28 PLN in the year.

Interestingly, it is not necessary to have four children for the entire year to take advantage of this relief. If, for example, the fourth child was born in December, you can still take advantage of this for that year.

- Donations

You are entitled to a discount on donations to Public Benefit Organizations (OPP) if you have made a donation for the purposes specified in the Law on Public Benefit Activity and Volunteerism.

You can make a donation to:

- Non-governmental organizations, mostly charities and associations, that:

- are not units of the public finance sector,

- do not operate for profit,

- including churches, associations of local government units and social cooperatives.

- are not units of the public finance sector,

- Equivalent organizations operating in other member states of the European Union (EU) or countries belonging to the European Economic Area (EEA) that carry out public benefit activities and pursue public task objectives.

What are the rules?

You are eligible for a relief if you earn taxable income under:

- the tax scale (12% or 32%) at PIT-36 or PIT-37 returns,

- lump sum tax at PIT-28 return.

The deduction of donations is limited to 6% of your income or revenue. You can deduct the donation already made, but it cannot exceed this limit.

CIT-taxed companies can also deduct donations. In their case, the limit is 10% of income.

Be careful. The amount you did not deduct in your tax return – because you did not have enough income (revenue) – cannot be deducted in subsequent years.

How to document the right to relief in this case?

- Cash donation: proof of payment to the recipient’s payment account.

- Non-monetary donation: proof with details identifying the donor and the value of the donation, as well as a statement by the recipient of the donation that he has accepted it.

If the donation was made to an EU or EEA charity, you can deduct it if:

- The organization has a statement that it operates in accordance with Polish regulations on public benefit activities.

- There is a legal basis (e.g., a double taxation treaty) that allows the tax authority to obtain information from the country where the organization is headquartered.

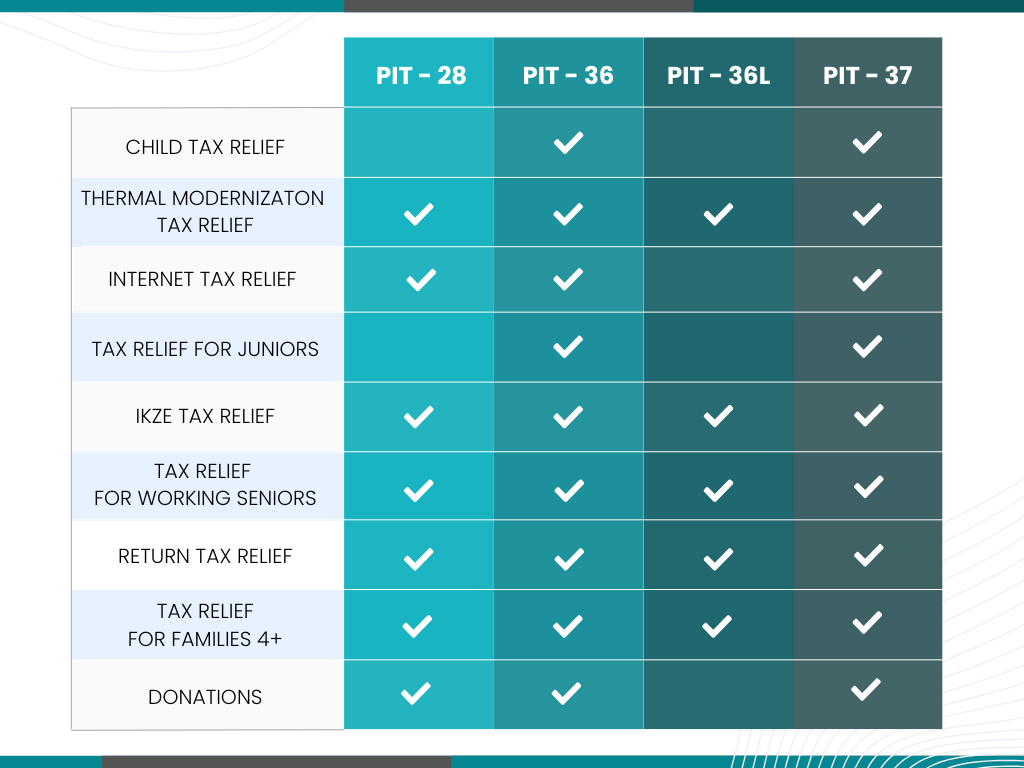

Friendly Table

Additionally, we have prepared a practical table for you, clearly outlining which tax reliefs are available in specific PIT returns. This will give you an initial idea of which reliefs you can consider when preparing correct PIT form for your incomes.

If you want to dive deeper into the topic of PITs, we invite you to read our article. It will help you understand which PIT form you have to submit for specific incomes!

Let’s summarize them

Tax reliefs are an effective way to optimize finances, although their rules can sometimes be convoluted. That’s not surprising. In this article, we’ve outlined the key information that will help you get an initial idea of what reliefs may be available to you.

Taking advantage of tax reliefs according to the regulations, however, is another matter entirely. Fortunately, you don’t have to worry about this. As an accounting company, we are perfectly capable of handling the formalities. We will help you through the entire process step by step.

If you’re still wondering which ones you’re entitled to, how to use them properly or what documents to prepare, we’re here to help you! Contact us and together we will find the best solution for you.

Updated on 30/01/2025