Have you received an offer to work on a B2B contract or have you been thinking about changing your employment contract to B2B? Before you do, you also need to know a few important things. In Poland, you can work on such a contract only if you have your own business, sole proprietorship or LLC. Here “does not exist” the concept of freelancing. In other countries, we do not exclude, it may look different.

If this prompts you to start, we encourage you to first read our post. It will give you the very specifics you need. Here you will learn what you definitely need to know before you decide to take such steps in Poland as a foreigner.

However, there are not only benefits associated with B2B, but also certain limitations and responsibilities. Take a moment to learn about them and see what works better for you.

So what should you know before signing a B2B contract?

B2B vs employment contract. Learn the differences.

A B2B contract is regulated by the Civil Act, while an employment contract is regulated by the Labor Act. The main difference between the two is how they determine where and when to perform their duties.

In the case of an employment contract, the Labor Act regulations precisely define the terms of employment, including the place and time of work. By contrast, in B2B contracts, one party cannot impose a specific time or place of performance on the other. This opens up room for flexibility and customization for both parties.

Remember! On the other hand, this flexibility allows a B2B contract to be terminated at any time. It can result in immediate loss of employment. In the case of an employment contract, there is a defined notice period. It gives some stability in the situation of termination.

Being on a B2B contract you are an entrepreneur, so you can enjoy the privileges associated with it . For example, there is the possibility of working freely with other companies or accepting additional orders. Entrepreneurs can also take advantage of leasing, which is often tax-beneficial.

What about vacations? Is there a difference here, too?

Employees, depending on the length of employment, are entitled to 20 or 26 days of paid vacation. In addition, they have the right to be absent on the basis of sick or special leave. In B2B cooperation, these privileges do not exist. So, that’s why it is important to take care of this when signing the contract.

Self-employment, so independent paperwork.

It is worth remembering, the employee has their Social Security contributions and taxes calculated and paid by the employer. A self-employed person, on the other hand, must fulfill these obligations on their own . A person who plans to start their own business must go through several formal steps.

First of all, you need to register your company, determine the scope of your business, choose a form of taxation and decide whether to be a VAT payer. Then, it is necessary to regularly pay taxes and Social Security contributions, and keep the accounting of your business. In addition, invoices will need to be issued for services or sales made – usually on a case-by-case or monthly basis.

However, many of these duties can be outsourced to an accounting company. It involves additional costs, but is a significant relief for an entrepreneur. We can definitely help you with this and relieve you of unnecessary worries that will go to your head.

Despite the numerous formalities associated with a B2B contract, this form of employment is strongly gaining in popularity.

Switch from employment contract to B2B. What are the limitations?

There are certain tax and social security restrictions that apply to individuals switching from an employment contract to self-employment (B2B), especially if they continue to provide services for the same employer.

As a self-employed person cooperating with former employer:

- You cannot choose just any taxation form: for two years (the year you switched to B2B and the following year) you are not allowed to use the lump-sum tax. Flat-rate tax becomes available from the year after.

- You are not eligible for the “starter’s relief”, you cannot take advantage of preferential ZUS contributions, nor of the “Maly ZUS Plus” scheme if you were employed by entity, which you start B2B cooperation with, within the last two years.

In practice, this means that while switching to B2B might seem financially attractive, it comes with significant limitations that should be carefully considered before making a decision.

So, here comes the most important question….

Does it pay off?

In a B2B contract, the net invoice amount is the total cost to the contractor (not including VAT). In the case of an employment contract, the total cost of employment is not even the gross salary. Employer still has to pay Social Security contributions, the so-called “employer” part.

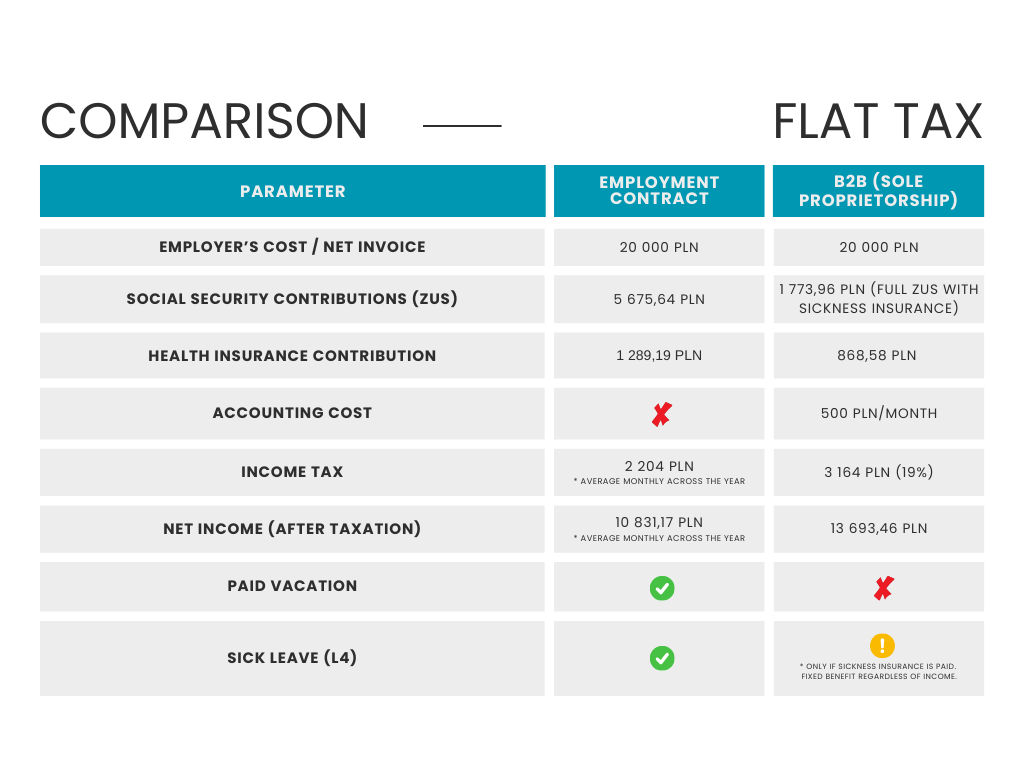

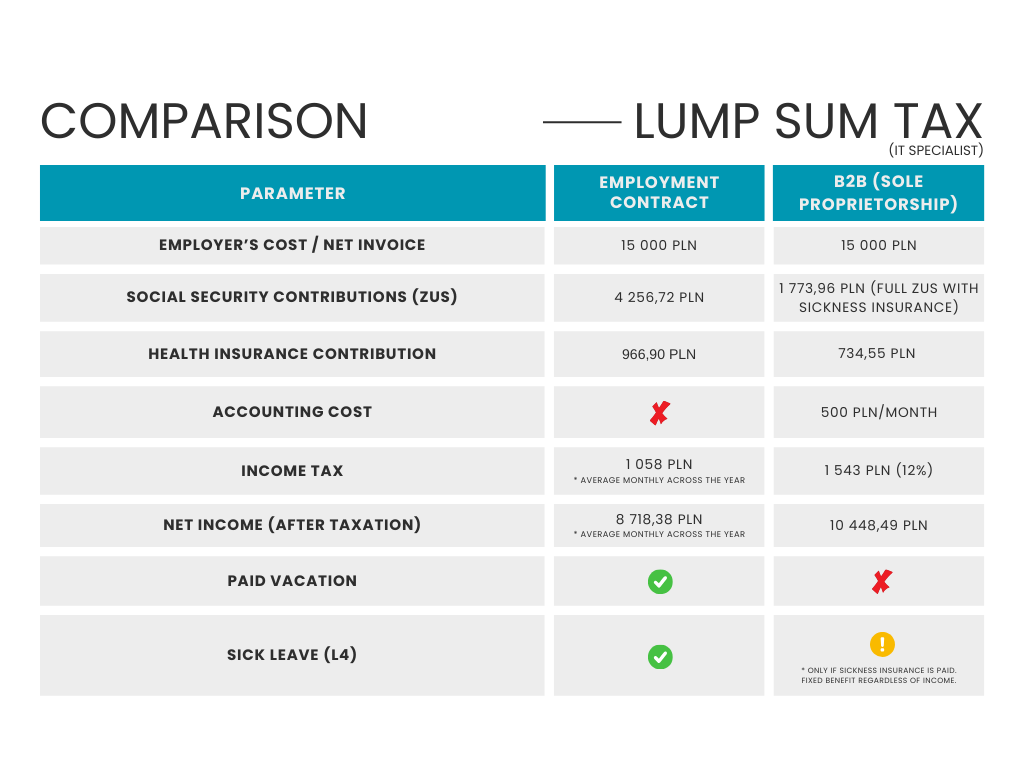

The higher your incomes are, the greater the net benefit from B2B is. With lower earnings, the fixed and relatively high ZUS contributions under self-employment can consume a large portion of your income, making this option less appealing. With higher earnings, the same fixed ZUS payment becomes a smaller percentage of your total income/profit, reducing its impact on your overall costs. On the other hand, under an employment contract, higher earnings mean proportionally higher ZUS contributions.

For incomes approaching the second tax threshold under employment contract (120 000 PLN annually), switching to B2B is worth considering more (if possible), since in the second threshold the tax rate jumps to as much as 32%!

What does it look like in numbers?

For example, a gross salary of 10 000 PLN on an employment contract translates into 12 048 PLN in total cost to the employer. 7 147,39 PLN is the net salary that employee receives. The higher the salary, the greater these differences are.

It is worth to keep this in mind when negotiating the salary on a B2B contract. You can safely suggest the total cost to the employer (12 048 PLN in the example above) and start from this amount in negotiations.

Legal costs at B2B contract are varied. They depends on taxation form and level of ZUS contributions.

Of course, after receiving the money for the invoice, you have to pay taxes and Social Security yourself. On top of that, you have to subtract monthly accounting costs of approx. 500 PLN + VAT in the case of a sole proprietorship. In the case of a limited liability company it is 1 000 PLN + VAT. Despite these expenses, the final salary should be higher than on an employment contract.

Again, the higher the salary is, the greater the differences are. That is the higher the salary is, the more profitable B2B cooperation is. In the case of low salary, this profitability may not be there, so each situation should be analyzed individually.

A B2B contract is almost always beneficial for the employer, but it does not necessarily have to be so for the employee. Therefore, it is worth being aware. Recalculate everything to not get tricked into a situation where B2B cooperation is not profitable.

As always, the final decision should be preceded by a thorough analysis of your individual situation and consultation with a qualified person.

Quick examples:

So, to sum up

You should assess for yourself what the situation is like in to make the most advantageous choice. We also understand that many questions arise with this topic.

As a competent accounting company – we will help you not only with a thorough understanding of the situation, but also with the formalities. Not everyone feels like doing them when already running their business or just want to go for it. We will do it for you in the most professional way! Our key is your peace of mind.