So glad you are here and we will try to provide you most useful information and advices related to taxation forms of sole proprietorship in Poland.

Are you going to open your own business and prefer the simplest form, which is a sole proprietorship? If so, well, you need to know that it offers various taxation forms. It’s worth considering which one to choose, to tax your income most favorably. Check out the main differences between them and who they are for.

Let’s start – What are these forms?

You have three options for taxing your business income. Check which one is the most advantageous for you:

- Tax Scale:

– Rates: 12% and 32% + tax-free amount,

– Taxation of income,

– This is the primary taxation form, if you choose no other form.

- Flat-rate tax:

– Rate: 19%, no tax-free amount,

– Taxation of income,

– A simple and uniform form of taxation.

- Lump sum:

– Different rates, depending on the type of activity

– Taxation of revenue

– Not always available, some industries are excluded (e.g., pharmacies, exchange offices, auto parts dealers).

With the tax scale and flat-rate tax, taxation revolves around income and with the lump sum – around revenue.

To make wise decisions… understand with us: revenue, expenses, income

Revenue – it comes to you

- That’s all the money you deserve from your business, even if it hasn’t arrived yet on your account.

- This is the amount a company receives (or should receive) from customers for services or goods.

Expenses – what flies away

- These are business expenses that can be deducted from income.

- It includes things like materials, salaries, advertising, accounting and other costs.

Income – and that stays

- It’s what’s left over from revenue after deducting expenses.

- These are your real earnings.

Remember! The VAT amount is not included in revenue. Revenue for tax purposes is only the net amount, excluding VAT.

So what to consider when choosing a form of taxation?

- Do you want to deduct tax-deductible expenses.

Consider whether you want to deduct business expenses. If you plan to spend a lot on goods, services or equipment, it is worth considering a taxation form that allows you to include deductible expenses in your tax return. Choosing a lump sum, despite a favorable rate, can result in higher taxes, because it doesn’t allow for the deduction of expenses incurred.

- How much is the health insurance contribution

Starting in 2022, the amount of the health insurance contribution depends on your choice of taxation form and income.

If you are on the tax scale, the health insurance contribution is 9% of your business income. When you choose a flat-rate tax, you pay a 4.9% health insurance contribution on your income.

Worth remembering! If you are on the tax scale or flat rate tax basis and your income for the month is less than the 75% of minimum salary, the health insurance contribution for that month will be 9% calculated on 75% of the minimum salary. In 2025, the minimum salary is 4 666 PLN. This therefore gives a minimum health insurance contribution of 314,96 PLN (4 666 PLN × 75% × 9%).

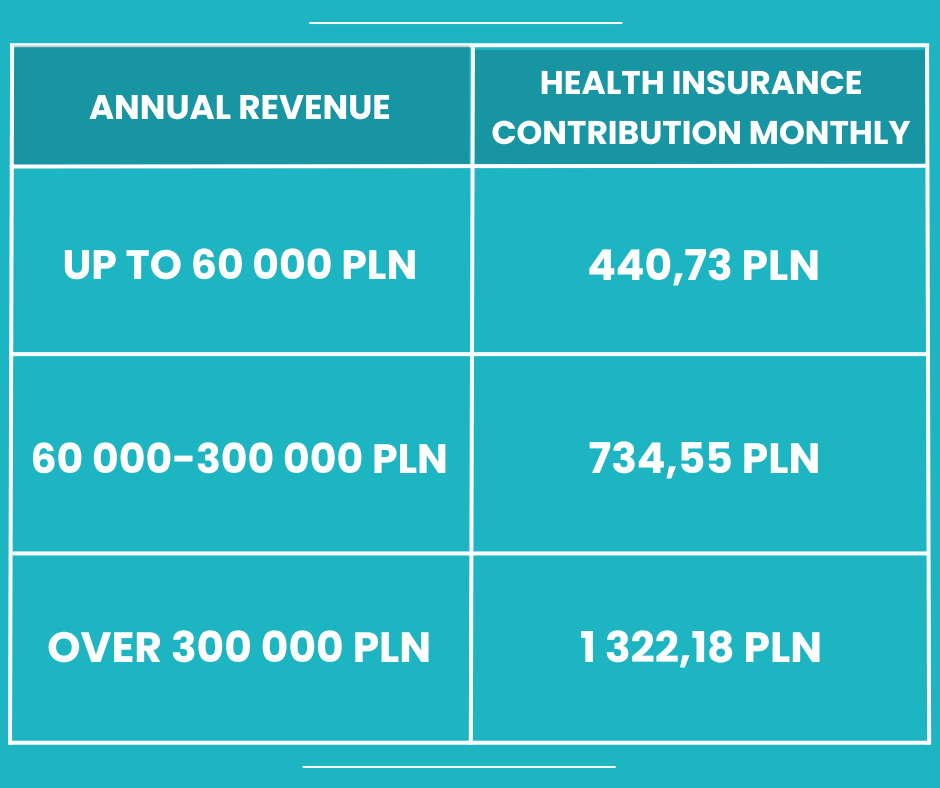

If you are on the lump sum, your monthly health insurance contribution depends on your revenue. There are three revenue thresholds (based on the average salary for Q3 of the previous year. In this case 2024 below), exceeding which results in an increase in the health insurance contribution.

You can see exactly what it looks like below.

- Do you want to settle a tax loss

Before making a decision on taxation form, consider if planned expenses are likely to exceed the revenues that you generate.

Particularly at the first step of the business or when planning investments, it may be advantageous to choose a taxation form in which it is possible to settle a tax loss, i.e. tax scale and flat-rate tax.

- Do you want to settle with your spouse

Consider whether you want to settlement with your spouse. If so, you must the tax scale.

The possibility of taxation together with a spouse excludes flat-rate tax or lump sum.

- Do you want to take advantage of tax reliefs

Keep in mind that choosing a particular taxation method can mean losing the right to many reliefs. All reliefs are available at the tax scale. With a flat-rate tax or lump sum, only certain reliefs are available. In both cases, the most popular relief – children – is not available.

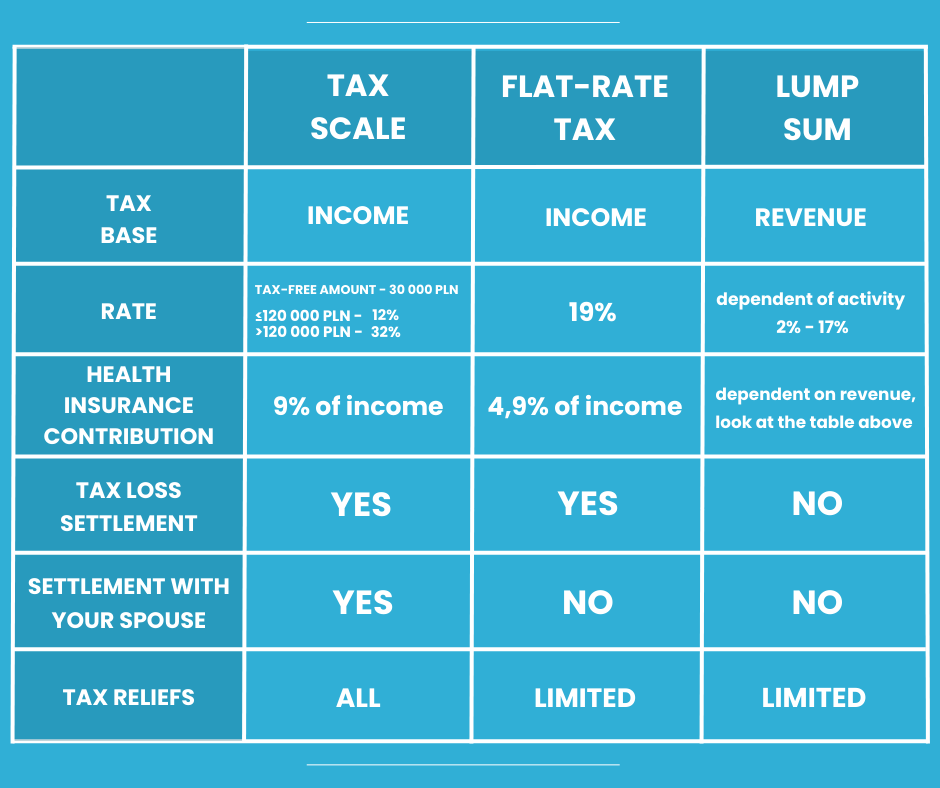

We present, again in a table, the differences between the above-mentioned taxation forms.

In this way we think it will be easier to understand them. Save it for later. Just for yourself.

Are you undecided… just in case, how could you change taxation form?

Of course, we won’t scare you, because you can still change it anyway. You can choose a different taxation form than the one used, but you have to do it in time.

- by the 20th day of the month following the month in which you receive your first business income in the year. It is usually by 20th February,

- by the end of the year – when your first revenue is in December of a given year.

You can make a statement about changing the taxation form:

- at the tax office,

- through CEIDG, changing your sole proprietorship’s data.

To sum up…

Choosing a taxation form for a sole proprietorship in Poland is a big step that affects the amount of taxes to pay and other liabilities. Each has its advantages and limitations, so you should think carefully about which one best suits your business.

It is worth thinking over the final decision with a specialist to make sure that chosen taxation form is in line with your needs and will bring optimal results. This way, you can focus on growing your business without an unnecessary worry.

We work with experienced tax advisors who will expertly assist you in choosing best taxation form. Once the right one is determined for you, we’ll be happy to help you open your business, and then take care of accounting and tax affairs.

Feel free to contact us if you need help with this issue, because as you can see above, it’s not all that easy in Poland. So it’s worth for the peace of mind, which we provide to our customers. Explore our offer now by contacting us!

Check our other articles at blog where you can find most important information regarding company opening link and must-know for expats and foreigners before setting up their business in Poland link

You can read more about the forms of taxation for a sole proprietorship here

Updated on 21/01/2025