Are you planning to expand your company and your next destination is Poland? One of the first things to think about is the legal form of your business activity in Poland. Most often it’s a choice between two forms. Subsidiary in the form of a limited liability company (LLC) and branch of your non-Polish company. Both options have their advantages and disadvantages, and choosing the right one depends on many factors. In fact, how do they differ?

The following is such a comparison. However, don’t forget that at our blog you will already find separate articles about limited liability company in Poland and branch of a foreign company.

First, let’s talk about accounting

It is a well-known fact that LLC in Poland is absolutely obligated to keep full accounting ledgers. The same is for a branch of a foreign company. So, when it comes to accounting – there is no difference.

It’s worth pointing this out, so, as a foreigner, you won’t be caught off guard. To avoid more unnecessary shock, we encourage you to work with a competent accounting company. We, as such, will be happy to assist you. Let us be a guide through all the processes that don’t need to be your concern.

So what are the differences?

The main difference between an LLC and a branch of a foreign entrepreneur is their legal status.

Unlike an LLC, a branch of a foreign entrepreneur has no legal personality. It constitutes an organizationally separate but legally dependent part of the business conducted outside the company’s headquarters. This is of significant practical importance – a branch has neither legal personality nor legal capacity.

“Maternal” responsibility

The branch operates exclusively within the structure of the foreign company. All rights and obligations related to its activities are in fact acquired by the foreign entrepreneur. The key consequence of lacking legal personality is the absence of independent liability of the branch. The parent company bears full responsibility for its operations.

In the case of an LLC, the company itself and, in certain cases, the board, are liable for the obligations. As a rule, shareholders are not liable for the company’s obligations.

Therefore, if the goal of a foreign entrepreneur is to limit liability to local assets only – LLC is a proper choice. In that case, a separate legal entity is established, possessing legal personality, and consequently legal capacity to perform legal acts.

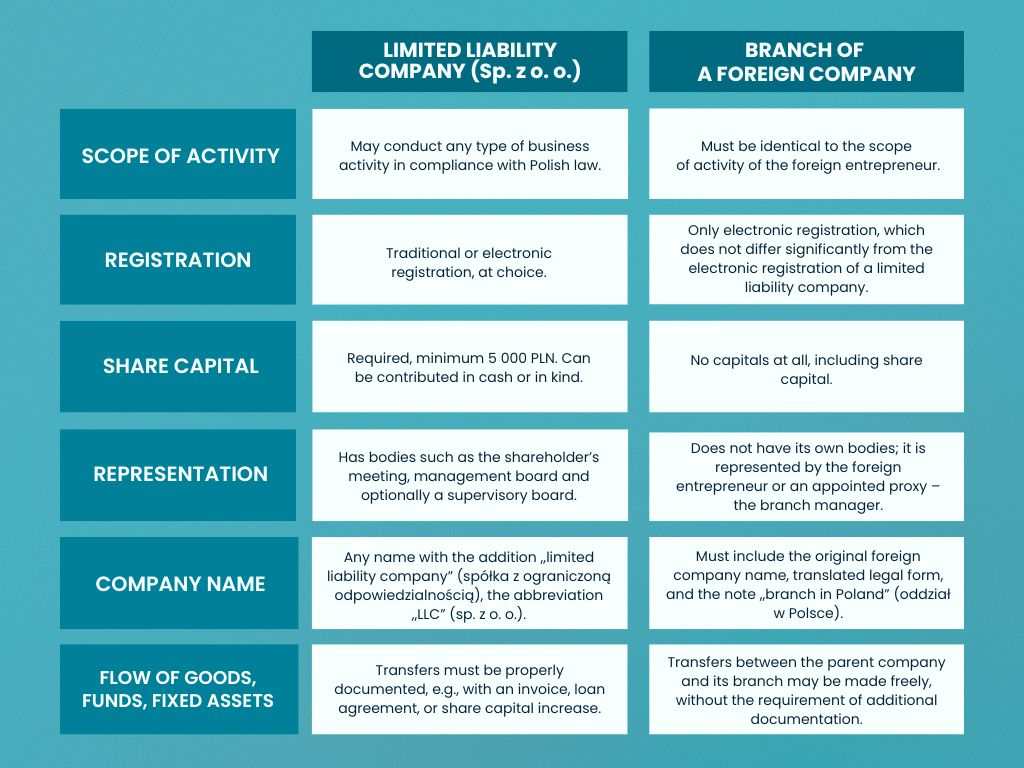

Scope of activities

LLC is an entity that gains full freedom in conducting business activities. It can pursue any activities compliant with Polish law. However, they must be included in company’s object of activities in the National Court Register (KRS). As a result, a limited liability company is free to expand into other industries or markets, which provides flexibility. This form is ideal for companies that plan a long-term, multi-faceted presence on the Polish market.

Branch is a legally dependent part of the parent company. This means that its activities are strictly limited to the scope in which the parent company operates.

So, for example, if your parent company is manufacturing furniture, a branch can’t suddenly start providing IT services. All the branch’s activities must coincide with what the parent company does. So, if the purpose of entering Poland is to duplicate activities in the home country, then branch can be considered.

Registration

The fundamental difference in the registration of LLC and branch is the form of registration itself. LLC can be registered in two ways. Traditionally through a notary or electronically (read more about this in our article on the registration of LLC in Poland). The branch registers only electronically.

The traditional way of registering LLC is costly, time-consuming and differs significantly. Electronic registration, on the other hand, is very similar in both cases. The main differences, although not very significant, are only in the required documents and legal fees.

Share capital

Minimum share capital in LLC is 5 000 PLN. This contribution is made by the shareholders. You may provide it in cash or as a non-monetary contribution (in-kind contribution).

The branch has no share capital. Its operations are financed directly by the parent company, making it fully dependent on its financial condition.

Representation

LLC is represented by a board. Its members have a power of attorney to act on company’s behalf. The members of the board are registered in the National Court Register (KRS) and are liable for the company’s obligations if they fail to fulfill their duties. They do not have to be affiliated with the parent company in the case of a subsidiary.

Branch is represented by a representative who is authorized to act on its behalf. This representative is responsible for the branch’s paperwork. However, it is the parent company that bears full legal and financial responsibility for its actions. The branch does not have its own board, and its representative acts under parent company.

Company name

Name of LLC is any. It only needs to include the designation “spółka z ograniczoną odpowiedzialnością” (limited liability company), abbreviated as “sp. z o. o.”, at the end. Other than that, anything can be added to the name. It doesn’t have to be related to the parent company at all if a subsidiary is being registered.

The name of the branch must include the full name of the parent company, the legal form translated into Polish and the phrase “oddział w Polsce” (branch in Poland). This means that there is no room for maneuver in the branch name and it is fully fixed in advance.

Flow of goods, money and assets

LLC is a separate legal entity. It means that all transactions between it and the parent company must be documented as if they were between two independent entities. The flow of goods and money requires invoices and other accounting documents. Assets (fixed assets, intangible assets) must be transferred to the subsidiary, which often involves additional formalities, such as in-kind contributions.

Branch acutely simplifies internal flows. The transfer of money, goods and other assets between the branch and the parent company is an internal movement. The money is actually moved between bank accounts of the same company and it does not require additional documentation. Although it must be properly booked, so in the case of goods and assets you need to know their values. Still, it’s a significant logistical and accounting convenience that minimizes paperwork.

By the way. Taxes in a branch are exactly the same as in an LLC. Of course, the branch does not apply to dividends. From the branch you can freely send money to the parent company, including the profits earned.

So, to sum up now

Choosing between an LLC and a branch of a foreign company is a strategic decision. You should make it after careful analysis of your goals and your needs for the business. LLC gives you more independence and the ability to limit your liability, but comes with more paperwork. Branch is less flexible and without limitation of liability. However, less paperwork for the movement of goods, money and assets is very helpful, especially in commercial or manufacturing industries. In these industries, the transfer between the parent company and the branch is sizable and this is what may prove crucial in choosing a branch.

As accountants, we reiterate that no matter what form you choose, the support of a competent accounting company is key. Proper accounting is essential. It’s worth entrusting it to professionals so you can avoid mistakes and focus on what you do best – growing your business.

Are you still hesitating and need help in choosing the right legal form? Or maybe you need support in the registration process? Contact us! As an experienced accounting company, we offer comprehensive services for setting up and running a business in Poland.